Maximizing Profits A Comprehensive Guide to Forex Trading Robots

Exploring MyCasino Bonus Unlocking Exciting Promotions and Rewards

30/10/2025The Ultimate Guide to Sonabet Your Gateway to Online Betting 1857775079

30/10/2025

Maximizing Profits: A Comprehensive Guide to Forex Trading Robots

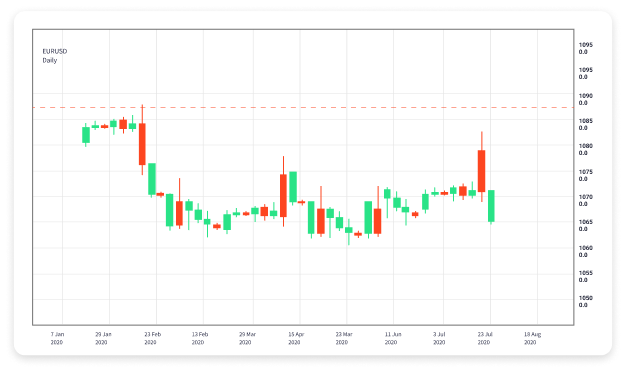

In the fast-paced world of forex trading, technology continues to evolve and shape the way traders operate. One of the most significant advancements in recent years has been the development of forex trading robots Saudi Arabia Brokers Forex trading robots. These automated systems, also known as expert advisors (EAs), have become increasingly popular among both novice and experienced traders. In this article, we’ll explore what forex trading robots are, their benefits, risks, and how to choose the right one for your trading needs.

What Are Forex Trading Robots?

Forex trading robots are software programs that identify trading opportunities and execute trades on behalf of the trader. They analyze market data using pre-defined algorithms and make decisions based on technical indicators, price action, and various market conditions. These robots operate 24/7, allowing traders to take advantage of currency fluctuations at any time without constant supervision.

The Advantages of Using Forex Trading Robots

1. Speed and Efficiency

One of the primary benefits of using forex trading robots is their ability to analyze vast amounts of data and execute trades in a fraction of a second. This speed can be crucial in the forex market, where currency values can change rapidly. By using a robot, traders can gain an edge over those who rely on manual trading methods.

2. Emotional Discipline

Trading in the forex market can be stressful, leading to emotional decision-making. Forex trading robots operate without emotions, adhering strictly to their programmed strategies. This eliminates the psychological barriers that can hinder a trader’s performance, such as fear and greed.

3. Backtesting Capabilities

Most forex trading robots come with backtesting features that allow traders to test their strategies against historical data. This capability enables traders to analyze the effectiveness of their strategies before deploying them in real-time trading, potentially increasing their chances of success.

4. 24/7 Trading

The forex market operates 24 hours a day, five days a week. Forex trading robots can operate around the clock, ensuring that traders do not miss out on profitable opportunities, even when they are away from their trading screens.

Potential Risks of Forex Trading Robots

1. Over-Reliance on Technology

While forex trading robots offer numerous advantages, relying solely on them can be risky. Market conditions change rapidly, and strategies that worked in the past may not be effective in the future. Traders should continuously monitor their robot’s performance and be prepared to make adjustments as needed.

2. Lack of Market Understanding

Some traders may choose to use forex trading robots without fully understanding the market or the strategies behind the robots. This lack of knowledge can lead to poor decision-making and significant losses. It’s essential for traders to invest time in learning about forex trading and the mechanics of the robots they choose to use.

3. Scam and Low-Quality Products

Not all forex trading robots are created equal. The market is rife with scams and low-quality products that promise unrealistic returns. Traders should conduct thorough research and due diligence before investing in any forex trading robot.

How to Choose the Right Forex Trading Robot

Selecting the right forex trading robot can be a daunting task. Here are some essential factors to consider:

1. Performance History

Before purchasing any forex trading robot, review its performance history and backtesting results. Look for transparency in reporting, and ensure that the robot has a proven track record of success over a significant period.

2. Customer Reviews and Reputation

Research online reviews and forums to gauge the experiences of other traders with the robot you are considering. A positive reputation within the trading community can be a good indicator of a reliable tool.

3. Customization Options

Some forex trading robots allow for customization of settings and strategies. This flexibility can be beneficial for traders who want to tailor the robot’s performance to suit their risk tolerance and trading style.

4. Support and Updates

Choose a forex trading robot that comes with reliable customer support and regular updates. The forex market is constantly changing, and regular updates to the robot’s algorithms can help maintain its effectiveness.

Conclusion

Forex trading robots offer significant benefits, including speed, efficiency, and the ability to eliminate emotional trading decisions. However, potential pitfalls such as over-reliance on technology and the market’s unpredictability must also be considered. By understanding both the advantages and risks associated with these automated tools, traders can make informed decisions that align with their trading goals. Choose wisely, stay educated, and leverage the power of technology to enhance your forex trading experience.