Step-by-Step Guide to Opening a Forex Trading Account 1697523047

Choosing the Right Forex Trading Broker A Comprehensive Guide 1804378532

09/11/20251xBet Japan Download APP Your Guide to The Best Betting Experience

09/11/2025

Step-by-Step Guide to Opening a Forex Trading Account

Opening a Forex trading account can be an exciting and potentially rewarding experience. With the rise of online trading platforms, individuals can now access the Forex market directly from their devices. This article will guide you through the critical steps of opening a Forex trading account, including choosing the right platform, gathering necessary documentation, and understanding trading terms. If you’re considering starting your Forex journey with forex trading account opening Thai Trading Platforms, this guide is particularly useful.

Understanding Forex Trading

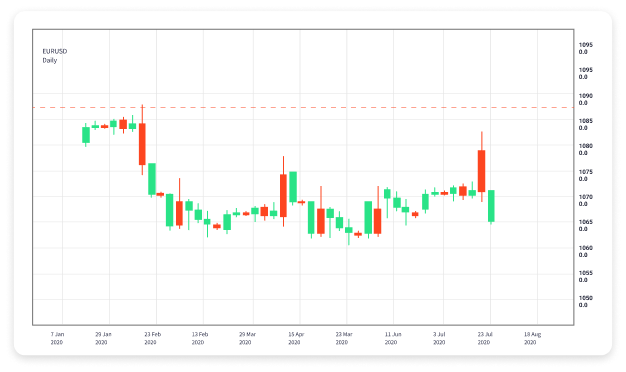

Before embarking on the journey to open a Forex trading account, it is essential to understand what Forex trading entails. The Forex market is a decentralized global marketplace for trading national currencies against one another. Trading occurs in currency pairs, such as EUR/USD, GBP/USD, and USD/JPY. Unlike stock markets, the Forex market operates 24 hours a day, five days a week, making it a flexible option for traders worldwide.

Choosing the Right Forex Trading Platform

Choosing the right Forex trading platform is one of the most crucial steps when opening your trading account. Factors to consider include:

– **Regulation**: Ensure that the platform is regulated by a recognized authority, which can help safeguard your funds and promote fair trading practices.

– **Trading Costs**: Look into the fees associated with trading, including spreads, commissions, and overnight fees.

– **User Interface**: A platform that is easy to navigate can greatly enhance your trading experience, especially for beginners.

– **Available Tools**: Check for tools that can aid in your trading decisions, such as charting software, analysis tools, and educational resources.

Gathering Necessary Documentation

Once you have chosen your trading platform, you will need to gather the necessary documentation to open your Forex trading account. These documents usually include:

– **Proof of Identity**: A valid government-issued ID such as a passport or driver’s license.

– **Proof of Address**: Recent utility bills, bank statements, or official documents that display your address (usually within the last three months).

– **Tax Information**: Some platforms may require your tax identification number or social security number, depending on your country’s regulations.

Completing the Application Process

After collecting the necessary documents, you can proceed to complete the application process on your chosen trading platform. The steps are typically as follows:

1. **Create an Account**: Visit the Forex trading platform’s website, and click on the “Open Account” or “Register” button.

2. **Fill Out Personal Information**: Provide personal details such as your name, email, and phone number.

3. **Submit Documentation**: Upload the required documents to verify your identity and address.

4. **Set Trading Preferences**: Indicate your trading preferences, such as leverage and margin requirements.

5. **Review and Accept Terms**: Read through and accept the platform’s terms and conditions before submitting your application.

Verifying Your Account

After submitting your application, the platform will review your information and documents for verification. This process can take anywhere from a few hours to several days, depending on the platform’s policies. Once verified, you will receive a confirmation email and can proceed to fund your account.

Funding Your Forex Trading Account

To begin trading, you must fund your Forex trading account. Most platforms offer various funding methods, including:

– **Bank Transfer**: A secure way to transfer larger amounts directly from your bank account.

– **Credit/Debit Cards**: Commonly accepted, though there may be limits on the amount you can deposit.

– **E-wallets**: Services like PayPal, Skrill, and Neteller offer quick and seamless transfers for online transactions.

Setting Up a Trading Strategy

Once your account is funded, it’s essential to develop a trading strategy before placing your first trade. A good Forex trading strategy will consider:

– **Market Analysis**: Familiarize yourself with both technical and fundamental analysis to make informed trading decisions.

– **Risk Management**: Establish how much of your total capital you are willing to risk on any trade, often referred to as the “risk-reward ratio.”

– **Trading Plan**: Create a structured plan that outlines your trading goals, entry and exit points, and the currency pairs you will focus on.

Beginners Should Consider Demo Accounts

If you are new to Forex trading, many platforms offer demo accounts that allow you to practice trading with virtual money. A demo account can be an excellent way to:

– Familiarize yourself with the platform’s interface.

– Test your trading strategies without risking real money.

– Build your confidence in Forex trading.

Conclusion

Opening a Forex trading account can initially seem daunting, but with a clear understanding of the requirements and processes, it becomes manageable. From choosing the right platform to developing a trading strategy, every step is essential for your success as a Forex trader. Always remember to trade responsibly, continuously educate yourself, and stay updated with market trends. Best of luck on your Forex trading journey!