The Global Forex Trading Landscape Trends and Insights

Is Mosbet Aviator Safe for Online Betting?

05/11/2025Unlocking the Secrets of Forex Algorithmic Trading Strategies and Insights

05/11/2025

The Global Forex Trading Landscape: Trends and Insights

In recent years, global forex trading has evolved into one of the most significant and influential financial markets in the world. With an average daily turnover exceeding $6 trillion, forex trading offers unparalleled opportunities for investors and traders alike. Understanding this vast market is essential for anyone looking to engage in currency trading. The development of technology and the rise of platforms such as global forex trading Crypto Trading App have transformed the way traders interact with the market and analyze trades.

The Basics of Forex Trading

Forex, short for foreign exchange, involves the buying and selling of currencies on a global scale. It is unique because it operates 24 hours a day, five days a week, allowing traders to engage with various markets across different time zones. Major currency pairs include EUR/USD, USD/JPY, and GBP/USD, which account for a significant portion of the daily trading volume.

Currency Pairs and How They Work

Currency pairs are categorized into three types: major, minor, and exotic pairs. Major pairs feature the most traded currencies globally, while minor pairs consist of less commonly traded currencies. Exotic pairs involve one major currency and one from a developing economy, offering different levels of volatility and risk.

Why Forex Trading? Advantages and Disadvantages

One primary reason forex trading attracts investors is its high liquidity; this allows traders to enter and exit positions easily. Other advantages include the ability to leverage trades, providing the potential for higher returns. Additionally, the forex market is relatively easy to access, with numerous brokerages providing trading platforms and resources for both novice and experienced traders.

Risks Involved

However, with the potential for profitability comes significant risks. The forex market is influenced by various factors, including economic indicators, geopolitical events, and market sentiment. Additionally, leveraging can amplify losses, making risk management a crucial component of any trading strategy.

Understanding Forex Market Trends

Market trends can significantly impact trading strategies. Understanding how to identify trends is essential for successful forex trading. Traders employ various techniques, including fundamental analysis (evaluating economic indicators and news) and technical analysis (analyzing price charts and patterns), to forecast future price movements.

Technical Analysis Tools

There are various technical indicators traders use, such as moving averages, Relative Strength Index (RSI), and Bollinger Bands. These tools help traders analyze price movements and market conditions, providing insight into potential entry and exit points.

Fundamental Analysis

On the other hand, fundamental analysis focuses on economic data releases, interest rate decisions, and global events. Economic indicators such as GDP, inflation rates, and employment statistics can significantly affect currency values, making it critical for traders to stay informed about the latest developments.

The Role of Technology in Forex Trading

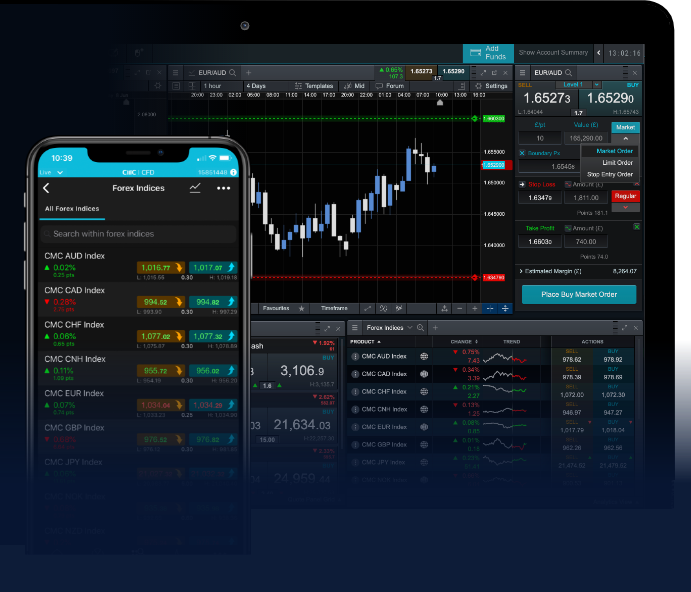

Technological advancements have revolutionized forex trading. The rise of online trading platforms has made it easier than ever for individuals to engage in the forex market. Automated trading systems have also gained popularity, allowing traders to execute trades based on pre-determined criteria without manual intervention.

Mobile Trading Applications

With the advent of smartphones, mobile trading applications have become a staple for traders looking to manage their portfolios on-the-go. These apps provide real-time access to market data, charting tools, and the ability to execute trades quickly, making them essential for today’s fast-paced trading environment.

The Future of Forex Trading

As the forex market continues to evolve, several key trends are likely to shape its future. The integration of artificial intelligence (AI) and machine learning in trading strategies is becoming increasingly prevalent, allowing for more sophisticated analysis and decision-making.

Regulatory Changes

Additionally, regulatory changes across different countries will impact how forex trading is conducted. Increased scrutiny from regulatory bodies may lead to tighter controls, affecting leverage and trading practices.

Conclusion

In conclusion, the global forex trading market presents numerous opportunities and challenges. As traders navigate this complex landscape, understanding market dynamics, technological advancements, and the risks involved is crucial. With the right knowledge and tools, individuals can capitalize on the vast potential of forex trading while managing risks effectively. The continual adaptation to changing market conditions will define success in this ever-evolving financial arena.