Maximizing Your Forex Trading Profit Strategies and Insights 1688849844

Experience Thrilling Online Gaming with Amonbet

03/11/2025Unlocking Forex Trading Profit Strategies for Success 1952863860

03/11/2025

Maximizing Your Forex Trading Profit: Strategies and Insights

Forex trading can seem like a daunting task for many, but with the right strategies and insights, it can be a lucrative endeavor. Whether you are a seasoned trader or just starting out, understanding how to maximize your forex trading profit Trading Platform QA is essential. This article delves into effective techniques and tips to help you become a more successful trader in the bustling world of foreign exchange.

Understanding the Forex Market

The Forex market, or foreign exchange market, is the world’s largest financial market, where currencies are traded. Its daily trading volume exceeds $6 trillion, making it essential for traders to grasp its dynamics. Unlike stock markets, which have specific trading hours, the Forex market operates 24 hours a day, five days a week. This continuous operation presents both opportunities and challenges for traders aiming to profit.

The Importance of a Trading Plan

A well-structured trading plan is crucial for success in Forex trading. A trading plan should outline your financial goals, trading strategy, risk tolerance, and criteria for entering and exiting trades. Without a plan, traders may be prone to making impulsive decisions based on emotions or market hype, potentially increasing the risk of losses.

Risk Management: Essential for Profitability

One of the key components of maximizing your Forex trading profit is effective risk management. Setting appropriate stop-loss levels can help protect your capital by limiting potential losses. A common guideline is to risk no more than 1-2% of your total trading capital on a single trade. This ensures that a series of losses does not significantly impact your overall trading account.

In addition to setting stop-loss orders, traders should also consider using take-profit orders to lock in profits once a certain price level is reached. This strategy can prevent the emotional decision-making that often leads to closing trades too early or holding on for too long.

Technical and Fundamental Analysis

To enhance your ability to predict market movements and maximize profits, it’s vital to utilize both technical and fundamental analysis. Technical analysis involves studying historical price charts and identifying patterns or trends. Traders often use various indicators to assist in this process, such as moving averages, RSI, and MACD.

On the other hand, fundamental analysis focuses on economic indicators, central bank policies, and geopolitical events that can influence currency values. Understanding when these events occur and their potential impact on currency markets will give you a substantial advantage in your trading decisions.

Emotional Discipline in Forex Trading

Forex trading is not only a test of skill and strategy but also a significant psychological challenge. Emotional discipline plays a vital role in maintaining a consistent trading performance. Greed, fear, and overconfidence can lead traders to make poor decisions. Developing a mindset that embraces patience and rationality is essential to maximizing your profits.

Utilizing techniques such as mindfulness and journaling can help traders remain disciplined and committed to their trading plans. Keeping track of trades, emotional responses, and market conditions creates awareness and helps refine trading strategies in the long run.

Continuous Learning and Adaptation

The Forex market is constantly evolving, with new economic data, geopolitical events, and technological advancements. Successful traders are those who continually educate themselves and adapt their strategies accordingly. Consider attending workshops, reading books, or following reputable Forex education platforms to enhance your knowledge.

Moreover, backtesting and forward testing different strategies in a demo account can provide valuable insights into what works best for you without risking real capital. The more adaptable you are, the better equipped you will be to maintain profitability in changing market conditions.

Leveraging Technology for Trading Success

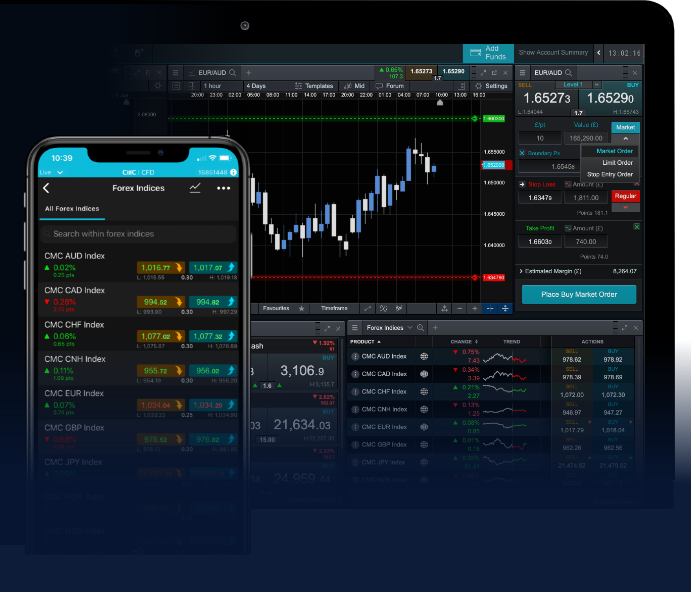

With advancements in technology, traders now have access to an array of tools and resources that can enhance their trading experience. Trading platforms, mobile applications, and algorithmic trading have made it easier to execute trades, manage portfolios, and analyze market data.

Choose a reliable trading platform that suits your trading style and offers features such as automated trading, advanced charting tools, and risk management options. Utilizing technology effectively can save time and reduce the emotional burden associated with trading.

Conclusion

In conclusion, maximizing your Forex trading profit requires a combination of careful planning, risk management, emotional discipline, and a commitment to continuous learning. By implementing these strategies, you can navigate the complexities of the Forex market with confidence. Remember, success in Forex trading does not come overnight; it is a journey that requires patience, dedication, and a willingness to adapt. Embrace the process, stay informed, and watch as your trading profits flourish.