Unlocking Opportunities in Forex Currency Market Trading

“казина Онлайн 2025 Топ Онлайн Казината В България

02/11/2025Explore the Thrilling World of 31bet Casino & Sportsbook -2125953780

02/11/2025

The forex currency market is one of the most dynamic and fast-paced financial markets in the world. For traders looking to make their mark in the financial world, understanding how to effectively navigate this market is crucial. This article delves into the intricacies of forex trading, highlighting essential strategies, market analysis techniques, risk management, and the roles that brokers, like forex currency market trading MT5 Forex Brokers, play in a trader’s success.

Understanding the Forex Market

The forex market, or foreign exchange market, is a global decentralized market for the trading of currencies. It is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike traditional markets, the forex market operates 24 hours a day, five days a week, allowing traders to buy and sell currencies at any time. Major trading centers include London, New York, Tokyo, and Sydney, enabling global participation.

How Forex Trading Works

Forex trading involves the simultaneous buying of one currency while selling another, using pairs such as EUR/USD or GBP/JPY. Each currency pair consists of a base currency (the first one) and a quote currency (the second one). The exchange rate reflects how much of the quote currency is needed to purchase one unit of the base currency. Traders use this system to speculate on currency price movements and make profits based on their predictions.

Key Players in the Forex Market

The forex market consists of various participants, each with their own motivations for trading. Major players include:

- Central Banks: Institutions like the Federal Reserve or the European Central Bank influence currency value through monetary policy.

- Commercial Banks: They facilitate currency transactions for clients and conduct proprietary trading.

- Institutional Investors: Hedge funds and investment firms engage in forex trading for portfolio diversification and hedging strategies.

- Retail Traders: Individual traders use online platforms, such as those provided by MT5 Forex Brokers, to engage in market activities.

Forex Trading Strategies

Successful forex traders utilize various strategies based on their trading style, market conditions, and personal preferences. Some of the more popular strategies include:

- Scalping: This short-term strategy focuses on making small profits from numerous trades throughout the day. Scalpers rely on market volatility and speed.

- Day Trading: Day traders open and close positions within the same trading day to avoid overnight risk.

- Swing Trading: This strategy involves taking advantage of price swings over a few days or weeks, requiring a more in-depth analysis of market trends.

- Position Trading: Longer-term traders who adopt this strategy may hold positions for weeks or even months, focusing on fundamental analysis.

Technical and Fundamental Analysis

Technical analysis involves studying historical price data and using charts to identify patterns and trends. Traders often rely on indicators such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to make informed decisions. On the other hand, fundamental analysis looks at economic indicators, news releases, and geopolitical events that can impact currency values. A combination of both analyses can provide traders with a more comprehensive view of the market.

Risk Management in Forex Trading

Risk management is a critical aspect of forex trading that every trader should prioritize. The unpredictable nature of the forex market can lead to significant losses, making it essential to have measures in place. Some common risk management techniques include:

- Setting Stop-Loss Orders: Automatically closing a trade when it reaches a predetermined loss level can help limit potential losses.

- Position Sizing: Calculating the correct trade size based on account balance and risk tolerance is vital to safeguard capital.

- Diversification: Avoiding overexposure to a single currency can mitigate risk and smooth out returns.

- Using Leverage Wisely: While leverage can amplify profits, it can also magnify losses. Traders should use leverage cautiously and be aware of their margin requirements.

Choosing the Right Broker

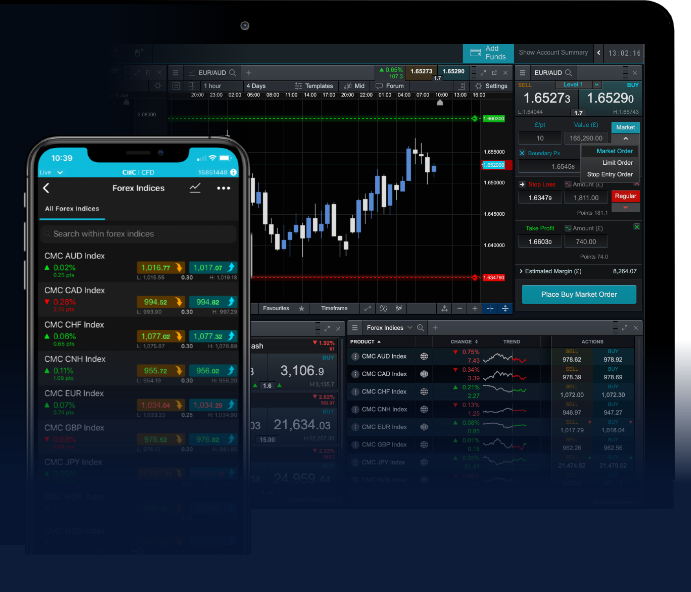

Selecting the right forex broker is fundamental to a trader’s success. Traders should consider factors such as regulation, trading platforms, spreads, commissions, and customer support. Brokers that offer user-friendly platforms, such as MetaTrader 5 (MT5), provide intuitive trading experiences, along with advanced analytics and tools. It’s crucial to conduct thorough research and read reviews before committing to a broker.

The Psychology of Trading

A trader’s mindset greatly influences their success in the forex market. Emotional decision-making can lead to hasty actions and notable losses. Cultivating discipline, patience, and a solid trading plan can help traders manage their emotions effectively. Journaling trades, analyzing outcomes, and learning from mistakes are essential practices for personal growth within the trading journey.

Final Thoughts

The forex currency market presents countless opportunities for those willing to learn and adapt. With a firm grasp of market mechanics, effective trading strategies, sound risk management practices, and a reliable broker, traders can enhance their chances of success. Remember that trading is not a guaranteed way of making money but a skill that requires dedication and continuous learning. Stay informed, remain disciplined, and embrace the exciting world of forex trading!